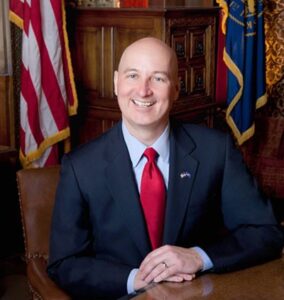

Get Nebraska Growing

Governor Pete Ricketts announced he will distribute $387 million in grants from the federal Cares Act for Get Nebraska Growing initiatives as part of the $7.8 billion in federal assistance that has come to Nebraska to aid the state’s coronavirus response.

Governor Pete Ricketts announced he will distribute $387 million in grants from the federal Cares Act for Get Nebraska Growing initiatives as part of the $7.8 billion in federal assistance that has come to Nebraska to aid the state’s coronavirus response.

- $100 million. Livestock Producer Stabilization Grant Program to help small livestock producers with 1-10 employees.

- $230 million. Small Business Stabilization Grant Program for businesses that employ 5-49 people. The application period for both programs opens June 15, with applications due June 26. getnebraskagrowing.nebraska.gov.

- $16 million. The Workforce Retraining Initiative at state community colleges for scholarships and workforce training. The community colleges will award scholarships (averaging $1,100) to individuals who are unemployed or underemployed due to coronavirus to prepare them for employment in high-demand career fields. Student scholarship applications will be available on each community college website beginning July 10 through July 31.

- $40 million. The Nebraska Broadband Grant Program intends to improve internet connectivity in small population communities (1,000 to 5,000) with limited work-from-home, tele-education, and telehealth services due to inadequate high-speed internet service. Broadband providers, with the support of local community officials, may apply for grants June 22 through July 2.

- $1 million. The Gallup Business Leadership Training Grant Program provides Nebraska business leaders with training to achieve organizational goals and drive growth through human development. Management teams will participate in a 30-week online course to learn techniques for leading teams through unprecedented challenges.

- Additionally, the Coronavirus Food Assistance Program (CFAP) provides $16 billion in direct payments to farmers and ranchers for compensation due to coronavirus-related price drops and market disruptions. The program already disbursed about $100 million to Nebraska agricultural producers. USDA will accept applications through August 28, 2020. farmers.gov/cfap.

For more information, go to getnebraskagrowing.nebraska.gov or call the Nebraska Department of Economic Development hotline at 855-264-6858.

Select File

LB803 (Hughes) MONITOR – SPEAKER PRIORITY BILL

- Creates a new promotional checkoff program for pulse crops, including dry peas, lentils, chickpeas or garbanzo beans, faba beans, and lupine. The bill also expands a waiver of a distance limitation for overweight/oversize vehicles transporting crops to include pulse crops.

General File

LB1084 (Kolterman / MONITOR)

- The Nebraska Transformational Project Act would provide $300 million in state funding to the University of Nebraska Medical Center for their NExT Project. Before receiving $300 million, UNMC must show the economic impact to Nebraska is at least $2.7 billion during the planning and construction period and at least $4.9 billion over ten years.

- NExT Project has two components: a state of the art academic medical center facility and a federal all-hazard disaster response military and civilian partnership.

LB1159 (Stinner) SUPPORT

- Extends the initial training period for a noncertified pesticide applicator from 60 to 120 days prior to obtaining an initial commercial or noncommercial applicator license. The bill also authorizes unlimited exam attempts for the noncertified applicator during that training period.

Held In Committee

LB919 (Wayne / MONITOR)

- Hemp cultivator, processor-handler, and broker license and renewal applications shall only be denied if they are incomplete or deficient, including for nonpayment of the required application and registration fees, or if the applicant does not meet minimum qualifications.

LB946 (Briese / MONITOR)

- The bill lowers the sales tax rate and eliminates exemptions on services. Service includes all activities that are engaged in for other persons for a consideration and that involve predominantly the performance of a service as distinguished from selling or leasing tangible personal property.

Failed to Advance

LB974 (Linehan) MONITOR – REVENUE COMMITTEE PRIORITY BILL

- A complex property tax reduction and school funding bill. As amended by AM2433, the bill would reduce property taxes as a significant source of funding for K-12 education. Unless expressly exempt:

- Real property would be valued at 95% of actual value for the tax year 2020, 91% in the tax year 2021, and 86% in 2022 and after that.

- Agricultural and horticultural land would be valued at 65% of actual value in the tax year 2020, for purposes of taxes levied by a school district and 75% of actual value for taxes levied by other political subdivisions.

- Agricultural and horticultural land would be valued at 60% of actual value in the tax year 2021, for purposes of taxes levied by a school district and 75% of actual value for taxes levied by other political subdivisions.

- Agricultural and horticultural land would be valued at 55% of actual value in the tax year 2022, and each tax year after that, for purposes of taxes levied by a school district and 75% of actual value for taxes levied by other